China is rapidly emerging as a global front-runner in the race to integrate AI with consumer hardware.

On June 26, 2025, Xiaomi officially launched its first pair of AI glasses, positioned as “the personal intelligent device of the next era and your portable AI gateway,” directly challenging the Ray-Ban Meta AI glasses.

Core Feature Comparison: Xiaomi AI Glasses vs. Meta AI Glasses

Here’s the comparison table with prices converted from CNY to USD using the latest exchange rate (¥1 = $0.1396 as of early July 2025):

| Feature | Xiaomi AI Glasses | Meta AI Glasses | Advantage |

|---|---|---|---|

| Price | ¥1,999 ≈ $279 | ¥2,400 ≈ $335 | Xiaomi (cheaper) |

| Weight | 40g (without lenses) | 49g (frame) | Xiaomi (lighter) |

| Audio | Dual speakers + 5 mics with sound leakage control | 2 speakers + 5 mics | Xiaomi (better quality & privacy) |

| Camera | 12MP (Sony IMX861), 2K 30fps video, phone integration | 12MP ultrawide | Xiaomi (video calls, scanning, livestreaming) |

| AI Features | Real-time multilingual translation (10 languages), LLM Q&A, smart home control | Meta AI Q&A only | Xiaomi (richer AI capabilities) |

| Battery Life | 8.6 hours (typical use) | 8 hours | Xiaomi (longer life) |

| Charging | 45 min (USB-C) | 75 min | Xiaomi (faster) |

| Ecosystem | Deep integration with HyperOS, Mi AI assistant, and smart home devices | Meta ecosystem | Xiaomi (stronger interconnectivity) |

| Style | 3 colors (black, tortoise brown, parrot green) | 20+ Ray-Ban styles | Meta (more fashion-forward) |

While Xiaomi lags slightly behind Meta in terms of fashion appeal and brand recognition, it demonstrates clear advantages in hardware performance, AI interaction, ecosystem integration, and pricing, especially within the Chinese market.

With more Chinese companies entering the space, leveraging lightweight design, intelligent features, high cost efficiency, and tightly integrated ecosystems, China is poised to lead global consumer AI hardware-software innovation.

China and the U.S. in Foundational AI Research: Each With Its Own Edge

According to Trends-Artificial Intelligence, the BOND AI trends report released by “Internet Queen” Mary Meeker, the U.S. and China are now in an intense phase of competition in AI. In foundational research, each country holds distinct strategic advantages.

🇨🇳 China’s Strength: Dual Engines of Open-Source Ecosystems and Industrial Intelligence

- China is rewriting the global playbook for AI through the explosive growth of its open-source ecosystem and rapid AI industrialization:

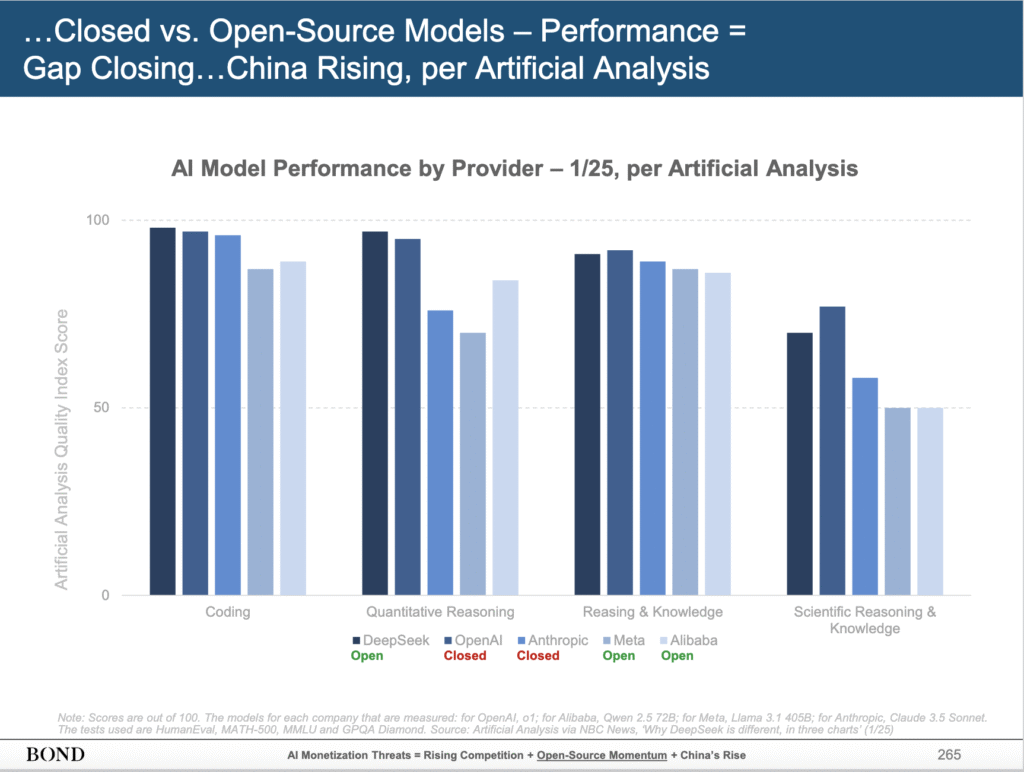

- Scale and Quality of Open Models: As of Q2 2025, China has released several benchmark open-source models, including DeepSeek-R1 (trained at just 1/10 the cost of OpenAI’s), Alibaba’s Qwen-32B, and Baidu’s Ernie 4.5, covering a wide range of use cases from language to multimodal and code generation.

- World’s Largest Open Model Hub: Alibaba Cloud’s ModelScope now hosts over 70,000 open models and has a developer base of 16 million, making it one of the largest open-source AI communities globally.

- Affordable, High-Performance AI: Chinese models like DeepSeek V3 are optimized for cost-efficiency, offering industry-grade performance at a fraction of traditional training costs (as low as 1/10). This affordability accelerates the democratization of AI in SMEs and developing nations, enabling broader global access to advanced technology.

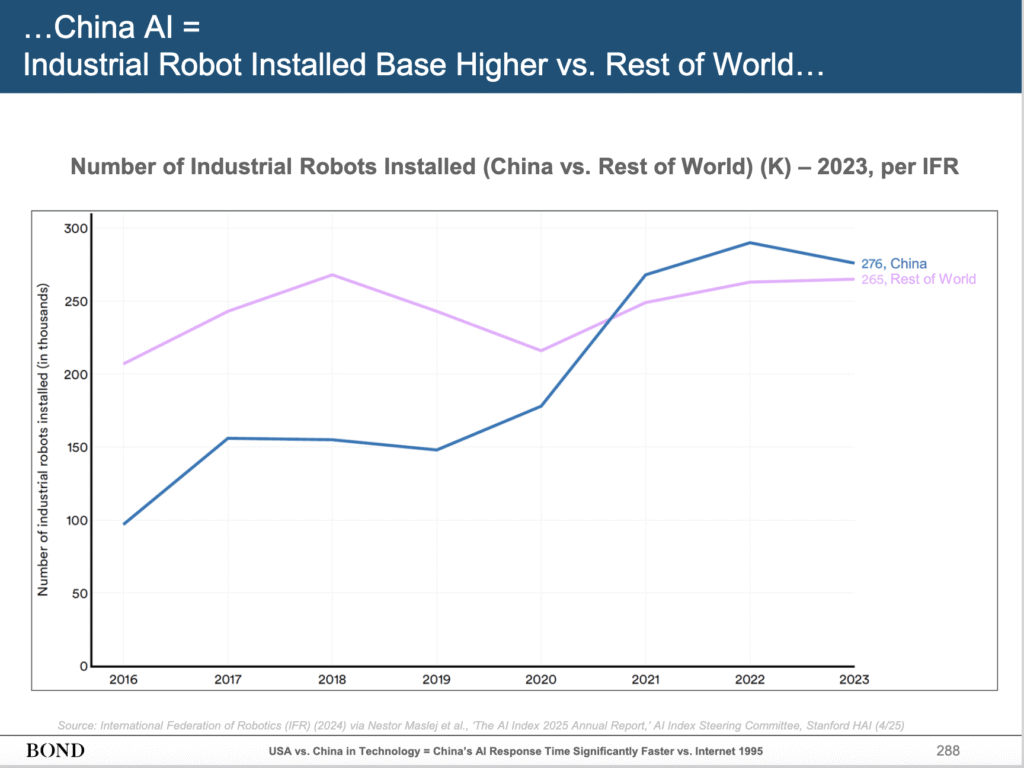

2. China’s Lead in Industrial Robotics: A Result of Policy Support and Supply Chain Strength

- Global #1 in Installations: In 2023, China accounted for over 50% of the world’s industrial robot installations. International manufacturers such as BMW and Tesla are already incorporating Chinese robotic solutions into their production lines.

- Challenges Remain: Despite rapid progress, China still relies heavily on imported high-end sensors and real-time control systems. However, domestic substitution is accelerating as local innovation and investment ramp up.

🇺🇸 U.S. Strength: Dual Advantage in Foundation Models and Chip Dominance

- The U.S. continues to hold a clear edge in the development of core AI foundation models:

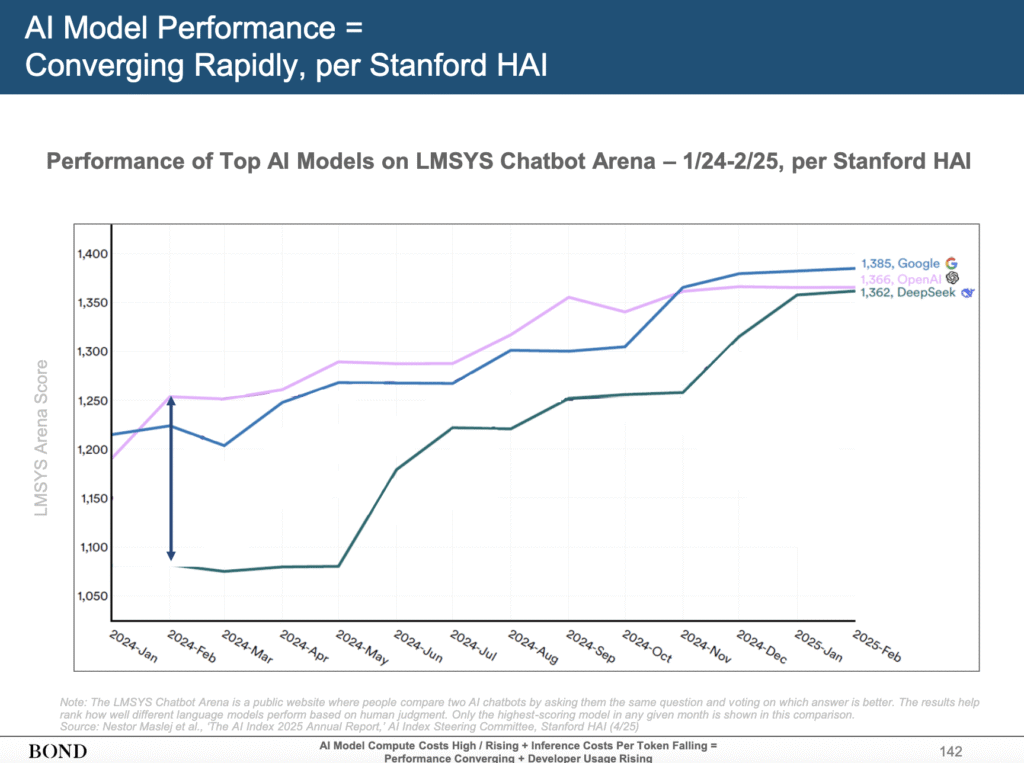

- Closed-Source Superiority: Proprietary models like OpenAI’s GPT‑4.5 and Anthropic’s Claude consistently lead on benchmarks such as MMLU and HumanEval, particularly in complex reasoning and long-context understanding.

- Open-Source Closing In: While Chinese models like DeepSeek-R1 have rapidly narrowed the performance gap (from 15.9% in 2023 to just 1.7% by 2025), closed-source U.S. models still dominate high-end commercial ecosystems, especially in enterprise and advanced research use cases.

2. Chip and Compute Supremacy: From Hardware Monopoly to Global Ecosystem Control

The U.S. has secured a dominant position in global AI infrastructure through its leadership in chip technology:

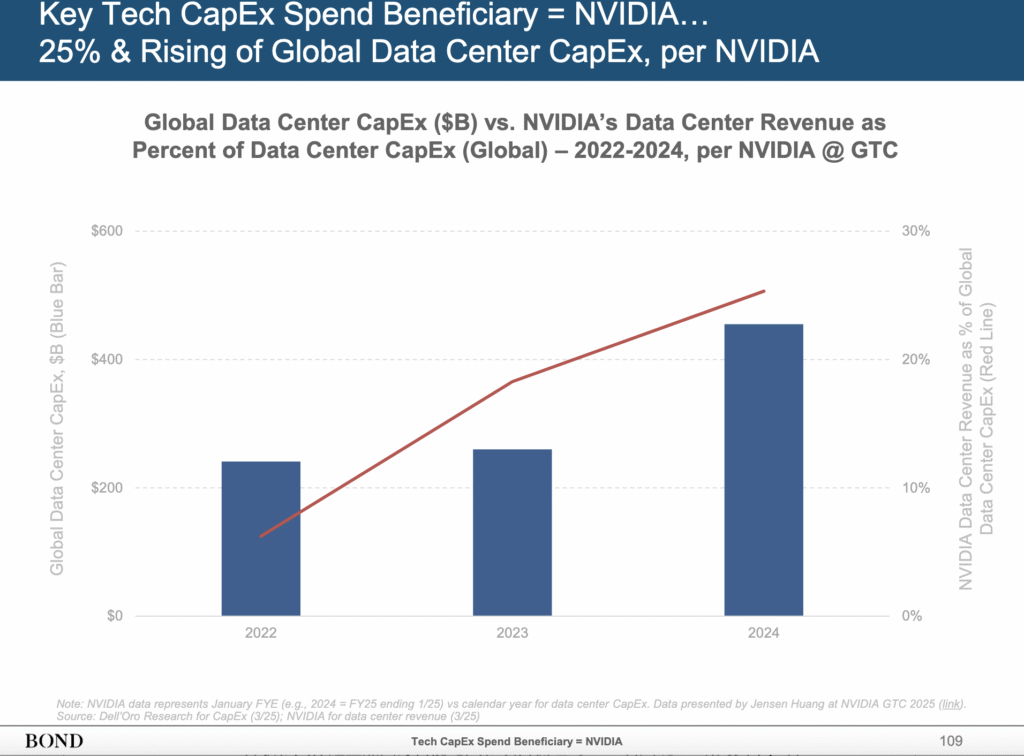

- NVIDIA’s Absolute Dominance: NVIDIA GPUs power over 90% of AI model training worldwide. Its hardware, particularly the H100 and H200 series, remains the gold standard for large model training.

- Infrastructure Leverage: NVIDIA-related compute accounts for an estimated 25% of global data centre capital expenditure (CapEx), underscoring its strategic role in the AI economy, from cloud providers to model developers.

Export Controls Spark a New Paradigm of “Accelerated Evolution” in China’s Chip Industry

Amid the growing U.S.–China tech decoupling, particularly around semiconductors, U.S. export restrictions on AI chips to China have triggered a powerful “crisis-response mechanism” across China’s chip sector:

- Technological Pressure: Real-world deployment demands are driving architectural innovation and improved chip yields.

- Market Pull: Rising substitution demand for domestic chips is fueling greater R&D investment.

- Strategic Loop: A dual-cycle strategy is emerging — import substitution at home, technology export abroad.

Beyond Huawei, Xiaomi has also entered the self-developed chip race — primarily to reduce material costs (mirroring how Apple’s M1 chip boosted Mac profit margins) and to mitigate geopolitical risk, such as potential sanctions or supply disruptions similar to Huawei’s.

The launch of Xiaomi’s Surge O1 chip marks the company’s first fully self-developed System-on-Chip (SoC) for smartphones, giving it core control from architecture design to functional integration. This shift reduces dependency on Qualcomm, lowers licensing fees, and improves gross margins, similar to how Apple used in-house chips to reduce reliance on Intel and unify its mobile and PC ecosystems.

In 2024, even NVIDIA CEO Jensen Huang acknowledged the shift, stating: “Export controls on China have failed. Our market share in China has dropped from 95% to 50% in just four years.”

Strategic Battleground

According to a study by MacroPolo, the think tank under the Paulson Institute, nearly half of the world’s top AI researchers received their undergraduate degrees from Chinese universities, compared to just 18% from U.S. universities. In 2019, that figure for China was only 29%, highlighting the country’s remarkable progress in cultivating world-class AI talent.

Take DeepSeek, for example — a team composed largely of graduates from top Chinese universities such as Tsinghua and Peking University. The team exemplifies a new wave of AI talent: highly educated, younger, open-source driven, and innovation-focused.

Similarly, Chinese talent is playing a critical role in Elon Musk’s Tesla Robotaxi project. Notably:

- Pengfei Duan, Tesla’s Chief Software Engineer for AI, earned his undergraduate degree at Wuhan University of Technology.

- Charles Qi, the machine learning engineer behind Tesla’s Full Self-Driving (FSD) system, graduated from Tsinghua University.

These cases clearly demonstrate that China’s homegrown AI talent is now shaping global innovation at the highest levels.

Summary

In the global AI race, China is swiftly narrowing the lead, driven by two key strengths: seamless hardware–software integration and a rising wave of homegrown AI talent. The launch of Xiaomi’s AI glasses marks not only a milestone for China’s consumer AI hardware but also highlights its unique strengths in ecosystem integration and cost-effectiveness. Meanwhile, China’s momentum in open-source models and industrial robotics is actively reshaping the global AI landscape.

At the same time, the United States maintains a firm grip on the foundations of AI — core algorithms and semiconductor supremacy, particularly in high-end compute infrastructure and closed-source model ecosystems. The core of this technological rivalry has shifted from pure performance benchmarks to a full-scale competition of ecosystems and innovation models.

Looking ahead, as China continues to export top AI talent and deepen its industrial chain integration, the global AI landscape may be on the brink of a major realignment. As NVIDIA CEO Jensen Huang put it, “Technology blockades only accelerate innovation.” In this silent war of systems and scale, China is advancing its own AI era, driven by openness and grounded in real-world applications.